Double Entry Bookkeeping Tutorial Pdf

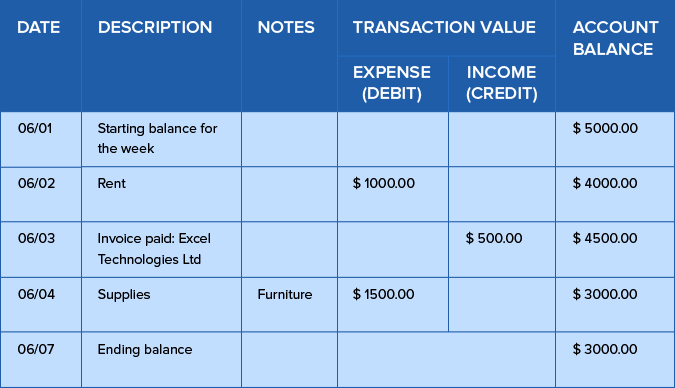

The transactions are stated in chronological order. Usually you need to prepare trial balance at the end of the said accounting period.

Difference Between Single Entry System And Double Entry System Zoho Books

The subject of this workbook is the Double Entry Accounting System.

Double entry bookkeeping tutorial pdf. Multiple Choice Questions 1 What ledger entries. 2 Double-entry bookkeeping Note. Select a Double Entry Bookkeeping Tutorial.

It is an excellent tutorial for anyone new to bookkeeping or. The double entry system of bookkeeping was first used by the merchants in Venice Italy. The balance sheet is a reflection of the basic accounting equation.

A minimum of one amount will be a debit entered on the left side of the account and at least one amount must be a credit entered on the right side of the account. Bookkeeping includes recording and classifying the financial transactions in books of accounts based on Accounting Double Entry principles preparing ledgers and extracting a trial balanceThe entries are recorded in the Books of Accounts by ensuring that each financial transaction is recorded in at least two different nominal ledger accounts. Each ledger contains various accounts listed in the chart of accounts.

Chart of accounts double-entry bookkeeping the general ledger and the 5 account types. The information from the documents is recorded into journals. Double entry bookkeeping an introduction.

One chapter referred to the double entry. What is Double entry bookkeeping. We offer free tutorials in all aspects of bookkeeping and accounting.

Partnership These are organisations owned by two or more persons working in common with a view to making a profit. 11 Example A small company named ZiscoSys. However if your business by nature remains very small and uncomplicated then you need not be concerned by this.

Double-Entry Accounting Page 1 of 3 A double-entry system requires the use of two or more accounts for each transaction s es s orth enue-Like a see-saw these must balance in a double-entry. Business transactions produce documents. Start Today and Become an Expert in Days.

If you are keen on starting with single entry bookkeeping for your budding. View Tutorial 2 For Studentpdf from ACCOUNTING 0122008006 at Universitas Pelita Harapan. Join Millions of Learners From Around The World Already Learning On Udemy.

Double Entry Accounting Workbook Introduction. A friar Luca Pacioli published a mathematics book in 1494. These accounts are totaled and balanced in line with the accounting equation.

Bookkeeping is based on principles set in a text written in excess of five hundred years ago. Posting of Adjustment Entries In this step the adjustment entries are first passed through the journal followed by posting in. Business organisations Sole trader Company Partnership Sole trader organisations that are owned and operated by one person.

Double-entry bookkeeping Double-entry bookkeeping or double-entry accounting means that every transaction will result in entries in two or more accounts. Procedure shall only make clear the mechanics of double entry bookkeeping. There are no asset liability or equity accounts as per double entry bookkeeping so single entry bookkeeping cannot be used to produce a balance sheet.

Join Millions of Learners From Around The World Already Learning On Udemy. The data is taken from the journals and entered posted into ledgers. 1 8000 Owners Investment to start up the business 2 Purchase of equipment for 4000 paid in cash.

Ad Learn Bookkeeping Online At Your Own Pace. Assets Liabilities Owners Equity. Double-Entry Accounting Page 1 of 3 A double-entry system requires the use of two or more accounts for each transaction s es s orth enue-Like a see-saw these must balance in a double-entry.

This system has been in use since at least the 12th century and it continues to be the most effective financial accounting system today. Follow double entry system of accounts the total of all the debit and credit balance as appeared in trial balance remains equal. One side represents the assets of.

Select a Double Entry Bookkeeping Tutorial from the lists below. Start Today and Become an Expert in Days. A set of photocopiable blank ledger accounts is printed in the Appendix of Advanced Bookkeeping Tutorial and is also available in the Products and Resources section of wwwosbornebookscouk.

Chapter 1 3 There are three types of businesses. Overview of Accounting for Beginners Overview of Accounting for Beginners This Accounting tutorial provides an overview of the modern Accounting System and its four major components. We offer free tutorials in all aspects of bookkeeping and accounting.

Double entry bookkeeping and accounting is based on the basic accounting equation which states that the total assets of a business must equal the total liabilities plus the owners equity in the business. The basic steps of double entry bookkeeping. DOUBLE ENTRY BOOKKEEPING Tutorial 2 Part A.

Ad Learn Bookkeeping Online At Your Own Pace.

Bookkeeping Double Entry Debits And Credits Accountingcoach

General Ledger Accounting Double Entry Bookkeeping

Double Entry Accounting Accounting Basics Learn Accounting Bookkeeping And Accounting

General Ledger Sheet Template Double Entry Bookkeeping